Speaking on October 2 at Russia’s largest investment conference, Russian president Putin made a compelling case that Russia’s economy has not only not been seriously affected by sanctions, but that in fact, it stands to benefit from them.

He dismissed the recent fall in the value of the ruble, stating, as he has several times over the past few days, that Russia would absolutely not institute capital controls, and he argued that the cheaper ruble is in many ways a plus for Russia.

In response to the doomsayers, Putin pointed out that the Russian federal budget showed a net surplus of over 900 billion rubles (about 25 billion USD) for the first eight months of the year. This surplus amounts to 2% of the GDP, which is in stark contrast to the deficits run by all major Western countries.

This flies in the face of the assorted domestic liberal analysts and their Western peers who have been telling us for the last few years that Russia needs an oil price of close to $120 to balance the budget. It was no use trying to point out to them the logical conclusion, which entails from the facts that the Russian budget is denominated in rubles and that the Russian currency is the ruble, which would devaluate in pace with the decrease of the oil price, thus bringing the budget to a new level of equilibrium with a lower oil price. Events have now proved me right on this.

Correspondingly, the devalued ruble rate will increase profits in all other export sectors and thus replenish the tax coffers. Less competition from Western imports will also cushion the domestic sector industries. The battered Eurozone countries can only envy Russia for having its proper currency to enable such adaptation.

Putin stressed that even under these extraordinary conditions Russia will not need to increase the tax burden on businesses. Neither does Russia experience any EU-style cuts in welfare and retirement benefits; on the contrary Russia will continue investing in the social sphere.

There would be a big problem with the ruble depreciation were it to fuel inflation, but so far there are few signs of this. Putin pointed out that as of today the inflation expectations by the end of the year range from 7.5- 8 percent. This is of course high in comparison with what is usual for the Western countries but it is in fact only slightly higher than last year’s 6.5 percent.

The rise of the inflation rate is minor indeed, if we relate it to the decrease of the currency rate at a level of 30 percent. Putin assured that the hike in inflation would be of limited durance.

I agree. A certain period of time will naturally be needed to build up the logistics for alternative imports and for domestic replacement production.

Russia will continue to advance its economy through structural reforms and national programs of developing whole industries like the successful programs in the spheres of aviation, automotive and pharma industries.

To the previous priorities, Putin now added the need to achieve an industrial breakthrough so as to create powerful national manufacturing companies in machinery, technology and processing, no doubt for example in the field of oil drilling technologies.

It is already a foregone conclusion thanks to the contra-sanction of banning Western food imports, Russia will achieve significant growth in agricultural production and food industry.

Putin stressed that Russia aimed to achieve growth in the economy “not through pumping it full of liquidity” or other sorts of financial machinations, but through the structural reforms and targeted investments.

This was a swipe at Western countries, which keep up a façade of economic well-being only by means of massively accumulating new debt and the central bank financing referred to as “quantitative easing”. A recent study has shown that these massive debts in fact hide years of negative GDP growth in the West.

Putin also confirmed that Russia would in fact be infringing on the global hegemony of the US dollar. He declared that Gazprom had recently made the first trial deal of selling oil for rubles. Russia will now ever more actively start using the ruble and the national currencies of its counterparts in bilateral trade with China and other countries. Plans are developing in this vein with all BRICS countries and several countries of Latin America.

Russia intends to dramatically boost trade and investment cooperation with the aforementioned countries as well as those of the Asia-Pacific region at the same time when the Eurasian integration with Belarus and Kazakhstan will be boosted by new entrants joining. First in line are Kyrgyzstan and Armenia.

Finally, it should be stressed that Russia under Putin’s leadership will continue the serious work on improving the business climate, which was jump-started in 2012 after Putin’s reelection.

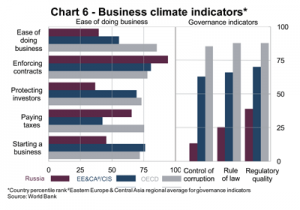

This work resulted already last year in Russia moving up 19 places to number 92 of 185 countries in World Bank’s “Ease of Doing Business” index of that year. The work on improving the business climate and debureaucratization is a tedious and time-consuming process involving expert work and legislative initiatives on how to optimize administrative processes and remove barriers in hundreds of fields of business activity. The various initiatives will mature little by little over the years. Therefore, this program will not provide for staggering headlines for the business press, but in fact, it constitutes a major reform project, which ranks high in Putin’s priorities.

Source Russia Insider

Jon Hellevig is a business consultant and economic and political observer. He is the co-editor and co-author of Putin’s New Russia and several books on philosophy and political and social sciences.

Comments