The British have identified a number of states that may be affected after November 2024.

The British think tank Economist Intelligence has published an interesting report called the “Trump Risk Index: the global impact of a new US presidency.” From the name, it can be understood that the British are trying to predict how the return of Donald Trump to the presidency of the United States will affect the situation in other countries. First of all, we are talking about the negative impact.

Ultimately, the US presidential election in November will be a key event for the global economy and geopolitics. As the authors of the report write, “we expect the 2024 US election is set to be an extremely close contest” between the Democratic and Republican candidates.

If Donald Trump were to win a second term, he would initiate sweeping policy changes across multiple fronts – from trade policy to national security – with global ramifications of these changes and Trump’d presidency are worth exploring.

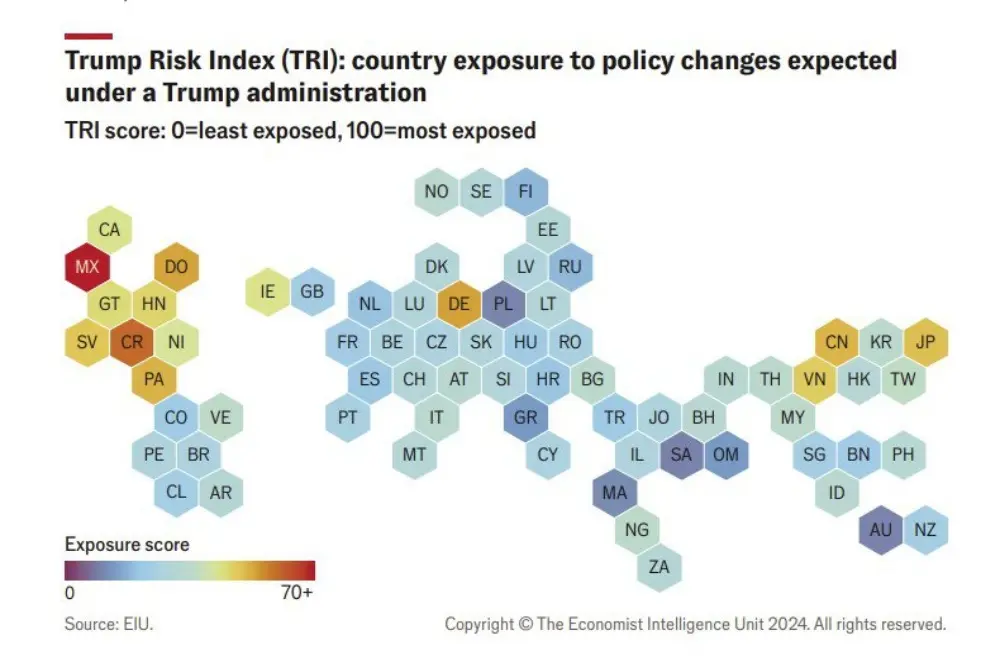

We have developed an index to assess the impact of the Trump presidency on individual countries. The Trump Risk Index (TRI) measures the broad exposure of the US’s 70 largest trading partners. Our overall risk score is based on an assessment of vulnerability across three areas—trade, immigration and security—where we would expect important policy changes under Mr Trump.

– Higher tariffs and trade restrictions (index weight is 40%): We believe that with some exemptions and compensations, Trump will fulfill his stated intention to impose a general tariff on imports from the United States; he proposed a fixed rate of 10%, although we believe that it will eventually be reduced. Additional punitive measures are likely to be taken against politically sensitive imports such as steel.

– Distribution of the security burden (index weight is 40%): US military assistance will become more conditional, and Trump will seek to balance key defense relations. The Trump administration will increase pressure on allies in the field of defense, demanding increased financial and material contributions.

Tightening of border controls and security measures (index weight is 20%): We expect the Trump administration to increase funding for the construction of the border wall and other deterrence strategies. Increased attention will be paid to the expulsion of migrants and some additional restrictions on legal ways of international labor migration and training.

We give more weight in TRI to the main areas related to trade and security, and less to immigration, to reflect the relative importance of these indicators in determining the overall impact of these changes on the country’s economy. Most indicators are estimated in relative terms, for example, in comparison with GDP or the population of a country, but some of them are considered in absolute terms. We use a point system to evaluate indicators in an indexed range from zero (least impact) to 100 (highest exposure) and use this as the basis for ranking geographical regions.“

The top ten partners of the United States are Mexico (71.4 points), Costa Rica (59.1), Germany (52.9), Dominican Republic (52.6), Panama (50.8), China (50.4), Japan (49.2), El Salvador (48.1), Vietnam (47.1), Honduras (45.8). As you can see, most of the countries in the top ten are from Latin America. If Mexico has a direct border with the United States and its exports/imports are significantly linked to its northern neighbor, as well as migration issues, then the rest of the Central American and Caribbean countries are at risk due to possible restrictive measures. China, Vietnam and Germany are at risk due to changes in the structure of bilateral trade. However, this is already happening with China, since the Biden administration, like the Republicans, takes a tough stance against Beijing and constantly introduces new restrictive measures.

What is quite indicative, Ukraine is not on the list, as if it does not depend on the United States, at least in terms of security. Moreover, there is no Ukraine at all on the map presented by Economist Intelligence, although there are smaller European and Asian countries. At the same time, Ukraine is mentioned in the context of a possible minor influence on Russia.

And in the list of countries least affected by Trump‘s re-election are the following: Saudi Arabia (9.4), Australia (9.7), Poland (10), Morocco (10), Greece (13.1), Oman (13.1), Finland (17.1), Russia (18.1), The Netherlands (19.9), Croatia (20.5). If we look at sectors, then in terms of protectionist tariffs, Mexico, China, Canada, Vietnam, Germany, Japan, Taiwan, India, Ireland and South Korea are in the top ten.

In the field of security, when pursuing a more isolationist policy during Trump‘s second term, Costa Rica, Panama, Germany, Bulgaria, Japan, Bahrain, Ireland, Malta, Guatemala and Estonia fall into the risk zone. As you can see, even in this segment there is no Ukraine. It is noted that such NATO allies in Eastern and Central Europe as Bulgaria, Estonia and Latvia have a high rating, because the reason for concern is their potential vulnerability if relations between NATO and Russia escalate into open conflict. Germany, which has a large number of American military personnel and spends a significant portion of GDP on defense, ranks third; at the same time, although Japan has some similar characteristics, it is rated as somewhat less vulnerable due to higher spending on American weapons. Several Latin American countries, including Costa Rica and Panama, which receive U.S. military assistance but do not have their own defense spending or their own spending is limited, are also at the top of the ranking.

Among the main NATO allies (or equivalent countries) Australia, Finland, Greece and Poland are considered the least vulnerable, aided by their own high defense spending and U.S. arms purchases. Oman and Saudi Arabia are important U.S. defense partners in the Middle East, but they are limited in their ability to make changes under the Trump administration due to their own extensive military spending. Non-aligned countries such as India and Singapore also have fairly low vulnerability, despite close military cooperation relations with the United States, as they rely heavily on their own defense resources.

Besides the descriptive part with possible consequences, Economist Intelligence also offers measures to reduce risks. It is stated that “governments and businesses can develop strategies to minimize the risks associated with policy changes that are likely to occur under Trump. A potential Trump administration is likely to take a positive view of the recent commitment by Germany and Japan to increase defense spending. Proactive steps could be taken to reduce trading risks. Ensuring proper controls to prevent the re-export of Chinese goods to the United States in order to avoid the imposition of tariffs would help to divert one of the likely lines of criticism from the United States. Government purchases of agricultural products and energy in the United States could alleviate concerns about trade imbalances. Companies exporting politically sensitive goods such as steel to the United States could consider diversifying the market to hedge higher tariff risks.

Building close relationships between leaders can also help. Trump‘s first term as president has shown that his decision-making can be influenced by interaction with other leaders. Japan’s then prime minister, Abe Shinzo, was able to secure trade concessions for his country thanks to Trump‘s careful courting.

It is also likely that some leaders will see Mr. Trump as an ideological ally with whom they can negotiate business and possibly provide benefits for their countries. Hungarian Prime Minister Viktor Orban or Argentine President Javier Miley stand out as likely ”Trumpists” in regions where most other political party leaders are likely to be ideologically distant from each other. Mr. Trump’s return poses a danger to some countries, but not to all.”

For Russia, the continuation of decoupling with China, the deterioration of US relations with Vietnam and India, as well as other countries that are focused on cooperation with BRICS+ and the SCO, may play into the hands of Russia. Although a click on the nose of a number of EU countries from the White House will be useful so that they feel their vassalage and think about whether it is better to follow strategic autonomy and their own sovereign decisions than to depend on the whims of the US political elites, which have recently been quite contradictory and unstable.

Comments