Let’s assume that planet Earth’s resources are finite, mining neighboring planets is in the distant—very distant—future and the world’s population is growing at an absurd pace. That means we are facing the problem posed by the famous English preacher, Thomas Malthus. Incidentally, here we should stop and ask ourselves, “Can anything good come out of Britain?” However, the fact remains that Reverend Thomas was the first to think globally and realize that there are a lot of people in the world and few resources—and that at a time when the Earth’s population was barely 1 billion people. Perhaps Malthusianism was a paranoid delusion at the turn of the 18th century, and it may still be today, but it has indisputably become firmly lodged in the minds of the Anglo-Saxon establishment on both sides of the Atlantic.

Let’s review some numbers.

The US population in 2005 was 294.4 million. The population of the European Union (Europe-25) that year was 459.5 million people, or 7.18% of the world’s total. The population of the United States, Japan and the other “more developed countries” made up 7.48% of the total, and the figure for the other countries in the Council of Europe, which includes Russia, was 5.39%. Russia does not belong to the “golden billion,” of course; however, the error introduced by including it is small. That adds up to 20.05%. China’s population alone was 20.34% of the total; India’s was 16.75%; and that of all other countries combined was 42,86%. The majority of the other countries are objects of plunder and exploitation by the West. India and China were among them during the colonial era. I cannot say that India is finally free of Western exploitation now, but China seems to be very close to it. Moreover, the Middle Kingdom’s economy lets it lay claim to a leading spot in the world.

Thus, Western man is now presented with the following vision of the future. He will not be alone in living in a comfortable city apartment, riding in cars with air conditioning and eating meat daily—the Chinese will be doing it, too. I would add this: a frightening number of Chinese will be doing it.

Is humanity ready for a doubling of the “golden billion?” That is the question, and the ruling class in the West finds it confusing, if not maddening, because a doubling of the “golden billion” by including Chinese citizens does not mean resources will be doubled. Just the opposite—the consumption of resources will be doubled.

However, let’s take it slow and start from the beginning.

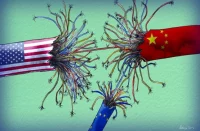

Relations between China and the United States, the military and political leader of the West, are as good today as they have ever been. That is actually true. For example, in November 2009 Obama made an official visit to Beijing and proposed something like joint governance of humanity to the Chinese leadership. As we know, humanity suffers from all kinds of chaos and needs to have order imposed on it. During the visit, theories about how the two economies are intertwined were voiced again, as was the need for joint efforts to fight the crisis caused by the United States; and the idea of forming a “Big Two (G2)—a US-China strategic partnership to solve a number of global and international issues—was put forward. Somewhat earlier, in January 2009, Henry Kissinger had told the London-based The Independent newspaper that the future world order will depend on the nature of US engagement with China and suggested that a new generation of American politicians build relations with the PRC based on a sense of common destiny, as transatlantic cooperation was built after World War II.

Certainly, much about Sino-US relations remains behind the scenes. However, no US president suggested to the Soviet Union or the Russian Federation after 1991 that they jointly govern the world and establish a G2. The proposal was made to the Chinese Communists. Moreover, Washington is making these proposals despite human rights violations in China and other infractions that the United States feels give it justification for occupying any country.

What about China? How does it react to Washington’s political overtures? The reserved Chinese leadership is in no rush to display strong feelings towards its North American partner; nevertheless, it does not find it necessary to hide the fact that US-China relations are quite good, although they could be better. For example, when President Hu Jintao visited Washington in 2011, he said, “China-US relations will enjoy smooth and steady growth.” Those were apparently not empty words.

What about China? How does it react to Washington’s political overtures? The reserved Chinese leadership is in no rush to display strong feelings towards its North American partner; nevertheless, it does not find it necessary to hide the fact that US-China relations are quite good, although they could be better. For example, when President Hu Jintao visited Washington in 2011, he said, “China-US relations will enjoy smooth and steady growth.” Those were apparently not empty words.

Former U.S. Treasury Secretary Henry Paulson said in his memoir “On The Brink” that in 2008 Russia tried to persuade China to join it in dumping Fannie Mae and Freddie Mac bonds in order to force the US government take them over. That would guarantee a return on investment. Fannie Mae and Freddie Mac control more than half of the US mortgage market, which is estimated at $12 trillion. A sharp drop in US housing prices caused them to lose $150 billion. The plight of Fannie Mae and Freddie Mac caused the U.S. administration to nationalize those corporations because their failure could cause a serious crisis, if not the collapse of the US financial system. Propping them up cost the US administration $400 billion, of which $85 billion went to finance their activities directly.

Paulson said he learned about the Russian proposal while he was in Beijing for the Summer Olympics. China refused to go along with the selloff; but according to Bloomberg, Russia sold its Fannie Mae and Freddy Mac debt for $65.6 billion in September 2008. That coincided with the takeover of Fannie Mae and Freddie Mac. What would have happened if China had agreed to the selloff? It is hard to say… Still, the global crisis of 2008-2011 has been blamed on the US mortgage crisis, which, in turn, caused the collapse of the five largest American investment banks, a 25% drop in US car sales and a surge in unemployment, among other things. In addition, while the US national debt at the beginning of the crisis in 2007 was $8.95 trillion, it has now passed the $14 trillion mark.

Paulson said he learned about the Russian proposal while he was in Beijing for the Summer Olympics. China refused to go along with the selloff; but according to Bloomberg, Russia sold its Fannie Mae and Freddy Mac debt for $65.6 billion in September 2008. That coincided with the takeover of Fannie Mae and Freddie Mac. What would have happened if China had agreed to the selloff? It is hard to say… Still, the global crisis of 2008-2011 has been blamed on the US mortgage crisis, which, in turn, caused the collapse of the five largest American investment banks, a 25% drop in US car sales and a surge in unemployment, among other things. In addition, while the US national debt at the beginning of the crisis in 2007 was $8.95 trillion, it has now passed the $14 trillion mark.

The assertion that the US and Chinese economies are closely intertwined is widely accepted. It is true, although there are some important nuances.

In 2008, China’s exports to the United States were worth $337.7 billion and its imports from the United States were worth $69.7 billion. China’s exports to the United States in 2008 amounted to 6% of GDP; US exports to China came to about 0.5% of the US GDP. China clearly would lose a huge market if the US economy were to collapse. Chinese imports are extremely beneficial to the United States. Americans consume Chinese products, paying for them with pieces of paper or simply numbers in bank accounts. By doing so, however, the United States is ruining its own manufacturers, which is not not a good thing in the long run because should problems arise it would not be easy to rebuild entire industries quickly. But the US leadership seems disinclined to worry about it.

What does China get in exchange for its exports to the United States? It gets US currency—commercially, virtually nothing. China is also buying US Treasury bonds, thereby keeping the US government afloat. It would seem that trade with the United States is a pure loss for the PRC. However, it is not that simple. The US dollar is the world’s currency, and China using it to buy up resources and shares of resource and manufacturing corporations throughout the world. When China has bought all of the resources that it needs or are for sale, it will no longer need the United States and its dollars. Or when the dollar printing press that is currently operating at full capacity stops turning US currency into bathroom wallpaper.

It is widely claimed that an economic meltdown in the United States would cause an economic collapse in China. That assertion appears to be true for the short term. However, China has a huge domestic market; and after losing the North American market for its exports, it would be able to quickly redirect the excess goods for domestic consumption. That prospect is discussed periodically in the Chinese press. In 2010 China had a 19.8% share of world production for a total value of $1.995 trillion. In 2009 Chinese exports totaled $1.2 trillion and were expected to reach $1.5 trillion in 2010. Thus, the people Chinese consume only a third of what they produce. They would, perhaps, consume more, but who will allow them to do that under current conditions?

Alas, despite the fact that China currently is the largest producer of commercial products, the standard of living for the average Chinese is still very, very low. China is only at 92nd place on the United Nation’s Human Development Index; Russia is number 71; and first place is held by the European countries. Canada is 4th, Japan is 10th, the United States is 13th, and New Zealand is 20th, i.e., the West plus Japan.

The structure of the US economy is interesting. In 2007, agriculture and the fishing industry had a 1.22% share of GDP, and mining had a 1.99% share; manufacturing had a 11.71% share, construction, 4.42%; and transport and warehousing, 2.95%. The finance, insurance and real estate services sector amounted to 20.36% of GDP.

The picture in China is completely different. Agriculture and the fishing industry had a 11.1% share of China’s GDP in 2007 ; mining had 5.2%; manufacturing – 34%; construction – 5.5%; transport and warehousing – 5.8 %; and finance and real estate services – 10%.

The picture in China is completely different. Agriculture and the fishing industry had a 11.1% share of China’s GDP in 2007 ; mining had 5.2%; manufacturing – 34%; construction – 5.5%; transport and warehousing – 5.8 %; and finance and real estate services – 10%.

If we accept the statement about the interdependence of the US and Chinese economies as correct, it is clear that in this relationship the United States is the consumer and China is the producer. Moreover, since China produces and the United States does not, China is using US currency to get its hands on all available resources, diverting them from US economic control. Otherwise, how can you get it to supply the population of the United States with cheap and high quality goods? Naturally, the U.S. government cannot stop it. It will not saw off the limb it is sitting on.

Here is an example. In August 2006, Afghanistan’s Ministry of Mines, which was and still is controlled by the US military, invited international investors to submit tenders for development of the world’s largest undeveloped copper deposit at Aynak. The candidates were Australia’s Bahar Consortium, India’s Hindalco Industries, Canada’s Hunter Dickinson, the Kazakh Kazakhmys company (which is registered in the UK), two Chinese companies—Zijin Mining and China Metallurgical Group Corporation (MCC)—and Phelps Dodge of the United States, as well as two Russian companies—Tyazhpromexport and Soyuzmetallresurs.

China’s MCC won the competition.

If China’s resource policy were a danger to the United States, how could a Chinese consortium win the contract? On the other hand, military control of the deposit remains in American hands and that is an important nuance for understanding US policy toward China. That policy rests on US military superiority, including that of its Navy. We will talk about that in a future article.

Source: New Eastern Outlook

Pingback: China-US: Big Guns As a Basis of Understanding | Oriental Review

China is protesting because the Dalai Lama is being met soon by President Obama. The Chinese don’t want any recognition of Tibet. Why not? Because the Tibetan plateau controls a great deal of China’s water supply. Some large rivers start up there and run from there down into China, irrigating a lot of it. If the Tibetans shut off those rivers, China would have big trouble on its hands. President Obama, no doubt, is well aware of this. Soon, he’s meeting the Dalai Lama, Tibet’s spiritual leader. Coincidence, I’m sure :-)